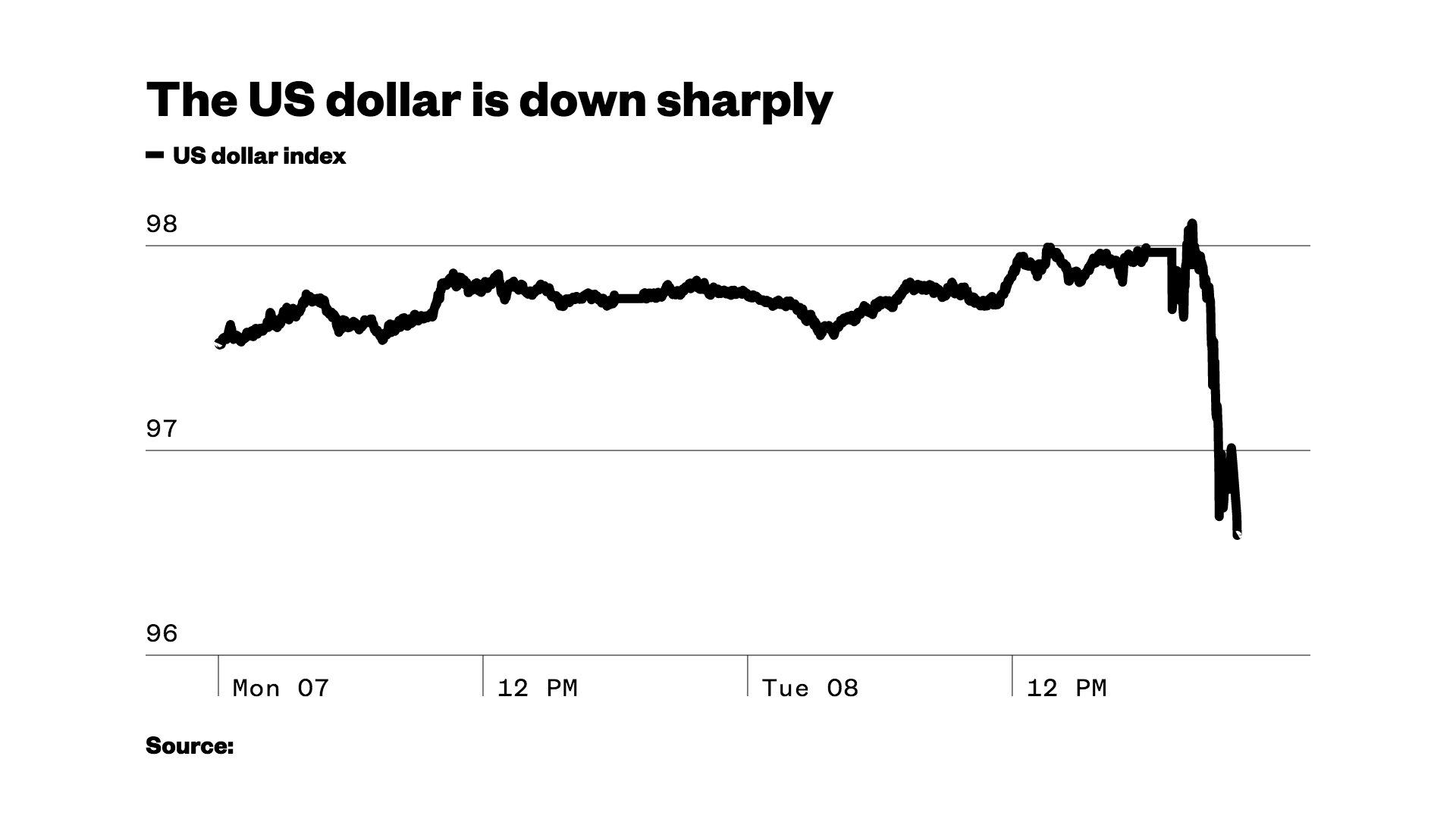

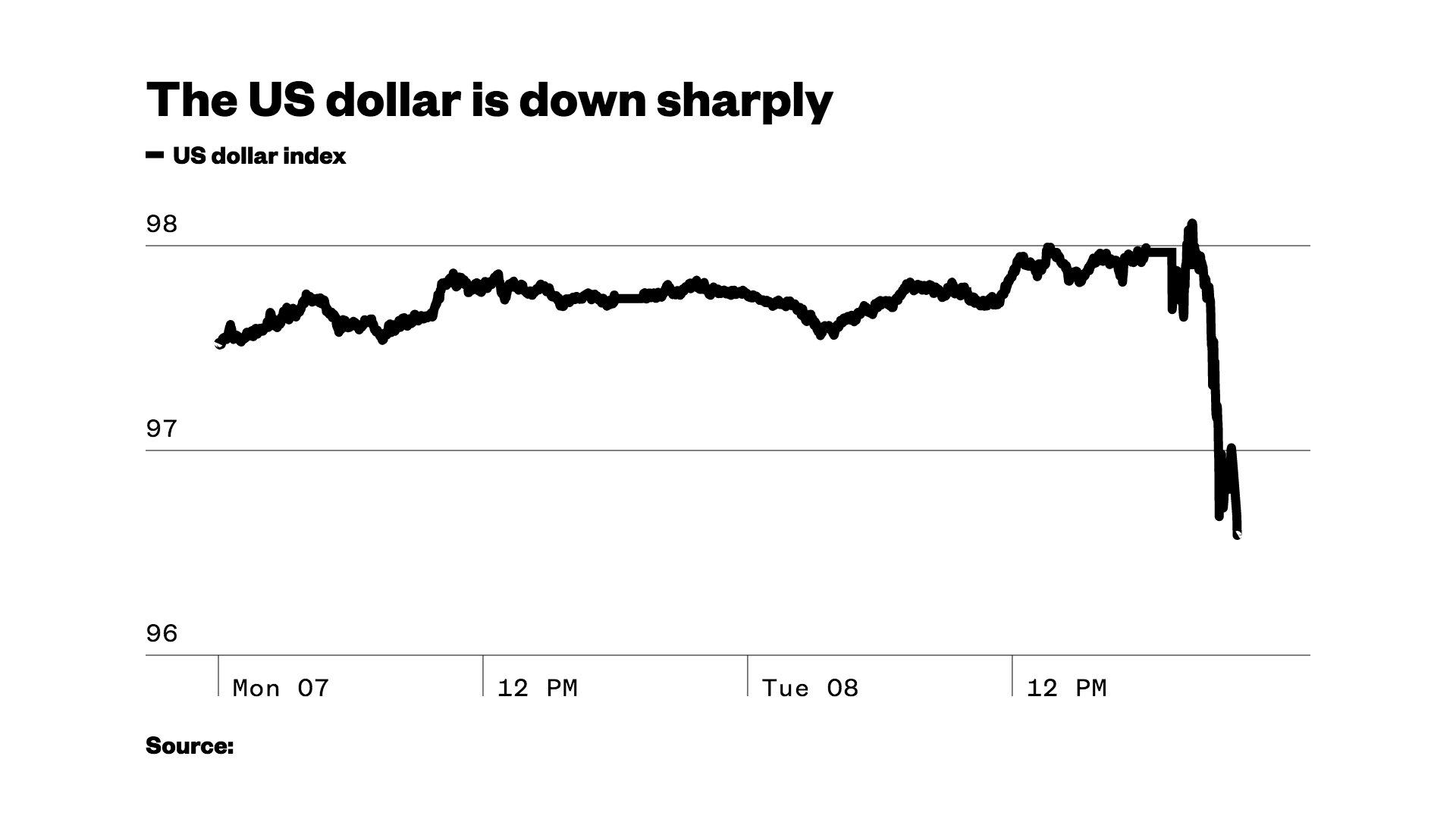

Donald Trump’s victory in the U.S. presidential election Tuesday upends decades of economic orthodoxy on trade, taxes, immigration, regulation, and geopolitical alliances. And it casts a massive cloud of political uncertainty over the economic outlook of the U.S. and the world.Trump’s triumph sent shockwaves through global financial markets. S&P 500 futures dropped as much as 4.9 percent after the Republican nominee started the night strong. Japan’s Nikkei tumbled 4 percent, and stocks in Hong Kong and mainland China also fell sharply. The Mexican peso, which has moved sharply on election news in recent months, plunged by 7 percent against the dollar. The U.S. dollar index dropped by a massive 1.7 percent. What’s the problem? No one knows whether Trump’s ad hoc, inconsistent, and improvisational style of campaigning will lead to equally erratic policy-making. Likewise, no one knows whether his comments about economic policies during the campaign — huge tariffs on Chinese and Mexican goods, tearing up and renegotiating NAFTA, withdrawing from the Asian trade deal known as TPP — are things he actually intends to do.But the initial market reactions suggest the depth of discomfort and uncertainty with which business leaders and investors view Trump. During the campaign, it was often difficult to discern policy positions from applause lines. But for economists, business leaders, and investors, they’re all deeply troubling.His strident anti-Chinese positions raise the prospect of increasingly frosty relations between the world’s top two economies. Trump has shown little respect for central bank independence and the idea that monetary policy must be free of political pressure so that money isn’t printed simply to achieve politically motivated goals. He has publicly spoken about trying to convince U.S. creditors to accept less on their holdings of U.S. government debt, a default that would tarnish the national credit first established by Alexander Hamilton.Beyond the realm of economic policy-making, a Trump presidency, if carried out in the spirit of his campaign, would call into question much of the post-war geopolitical order. He’s spoken of changing the nature of the U.S. alliances with large economies, from Europe to Saudi Arabia to Japan. He’s hinted that he wouldn’t necessarily honor the U.S.’ NATO obligations, which have served as a bedrock of world security — and therefore economic growth — for decades.How can investors and businesspeople who have been operating in a large, global, open economy react to the level of uncertainty and risk represented by a Trump presidency? They can’t do much besides run for cover — and that’s exactly what they’re doing.

What’s the problem? No one knows whether Trump’s ad hoc, inconsistent, and improvisational style of campaigning will lead to equally erratic policy-making. Likewise, no one knows whether his comments about economic policies during the campaign — huge tariffs on Chinese and Mexican goods, tearing up and renegotiating NAFTA, withdrawing from the Asian trade deal known as TPP — are things he actually intends to do.But the initial market reactions suggest the depth of discomfort and uncertainty with which business leaders and investors view Trump. During the campaign, it was often difficult to discern policy positions from applause lines. But for economists, business leaders, and investors, they’re all deeply troubling.His strident anti-Chinese positions raise the prospect of increasingly frosty relations between the world’s top two economies. Trump has shown little respect for central bank independence and the idea that monetary policy must be free of political pressure so that money isn’t printed simply to achieve politically motivated goals. He has publicly spoken about trying to convince U.S. creditors to accept less on their holdings of U.S. government debt, a default that would tarnish the national credit first established by Alexander Hamilton.Beyond the realm of economic policy-making, a Trump presidency, if carried out in the spirit of his campaign, would call into question much of the post-war geopolitical order. He’s spoken of changing the nature of the U.S. alliances with large economies, from Europe to Saudi Arabia to Japan. He’s hinted that he wouldn’t necessarily honor the U.S.’ NATO obligations, which have served as a bedrock of world security — and therefore economic growth — for decades.How can investors and businesspeople who have been operating in a large, global, open economy react to the level of uncertainty and risk represented by a Trump presidency? They can’t do much besides run for cover — and that’s exactly what they’re doing.

Advertisement