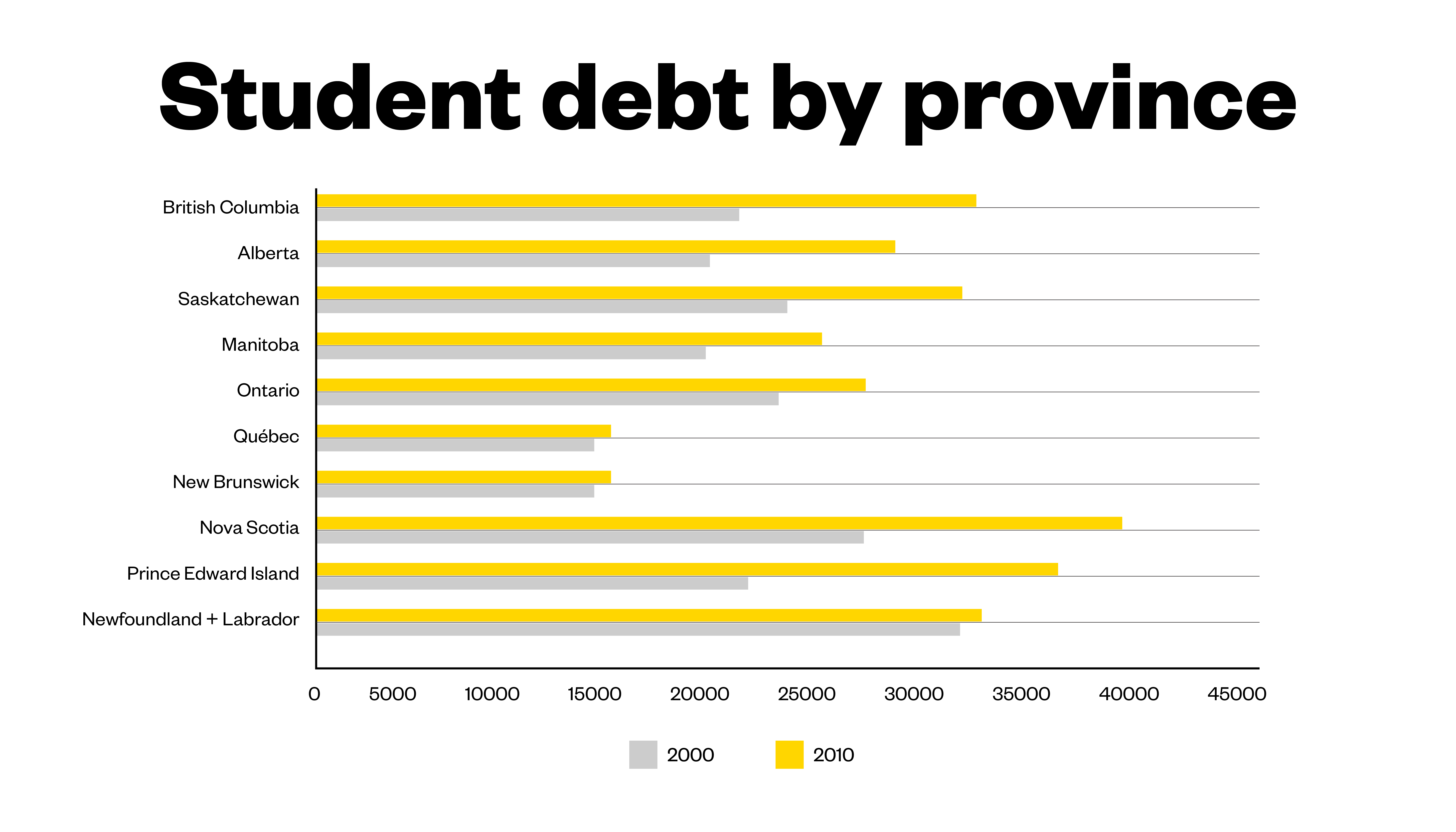

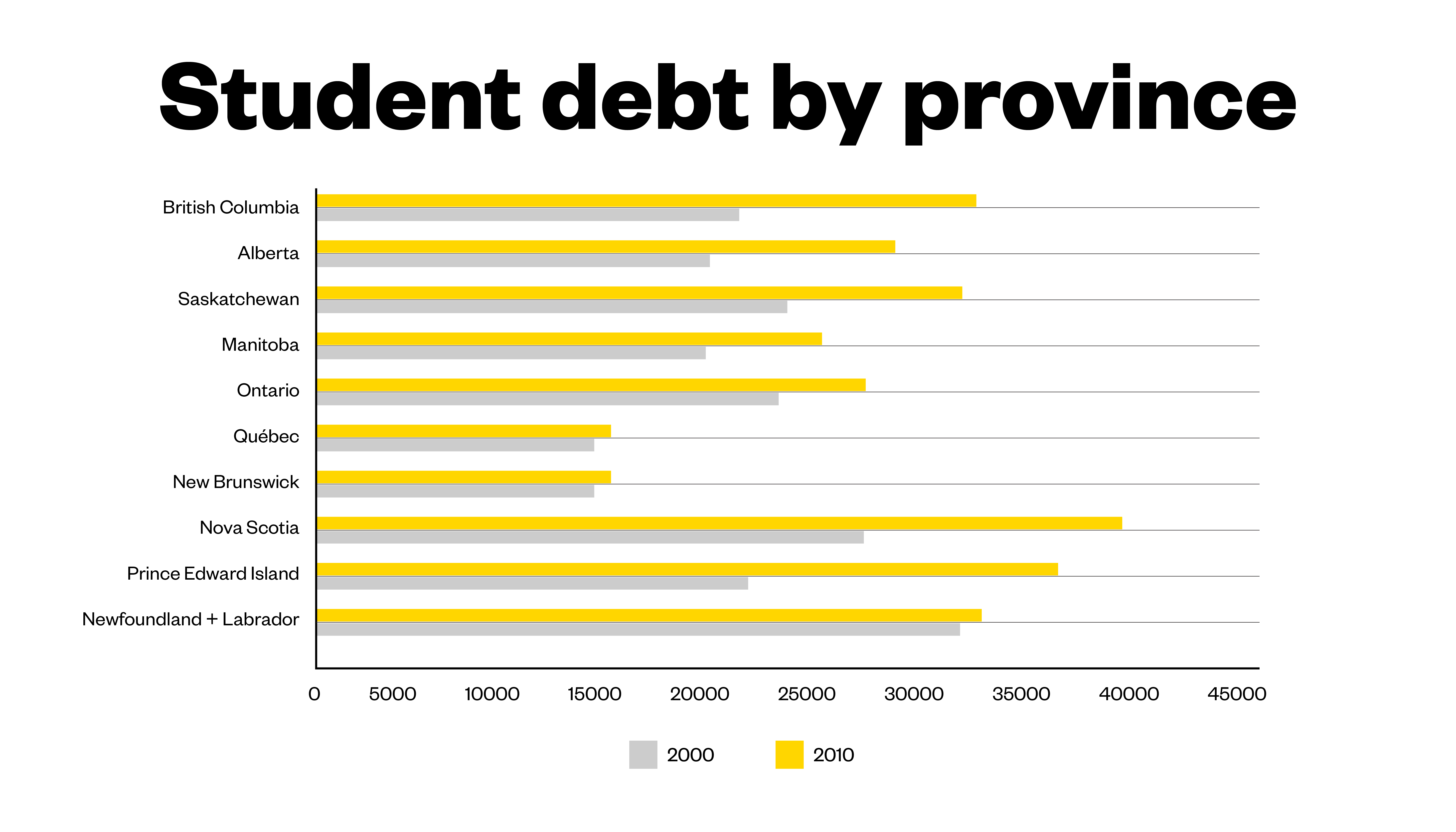

The federal government and Statistics Canada have been keeping track of post-graduation debt for the last two decades, and frankly, it’s not a pretty picture. According to the chart above, students in Atlantic Canada carry some of the greatest levels of debt as undergraduates. An undergraduate student’s debt load in Newfoundland and Labrador hasn’t changed much between 2000 and 2010, but still ends up being surprisingly high considering the province’s capped tuition costs. British Columbia has also seen a pretty wild increase since 2000 with $12,000 more in average debt load after a student has completed his or her undergraduate degree.It seems that, for the most part, Canadian students still need to either shell out big money or rely on government and private loans to finance their undergraduate degrees. In fact, students have been left with a collective debt of $28.3 billion according to a 2012 report from Statistics Canada. But what’s interesting is that provinces with the highest tuition fees don’t necessarily rack up the highest amount in student debt.When you look at the numbers, Ontario remains on top for average tuition costs (it cost $8114 on average in the 2016/2017 year) but remains in the middle of the pack when it comes to average student debt (roughly $27,000 according to 2010 Stats Can data).B.C. has a higher average debt to tuition ratio, meaning that for the amount they pay in tuition fees, their debt loads are pretty high.But the Atlantic provinces continue to stand out. In the 2016/2017 academic year, tuition fees for undergraduates in Nova Scotia was $7218 on average. The latest numbers (2010) on debt show us that they graduated with a debt load of almost $40,000. That number has surely increased in the last seven years, and is way above the overall cost of tuition.“It’s not the tuition fees, it’s the fact that you have to live somewhere for eight, to nine, to ten months of the year while you’ve got no money coming in,” Donna Mihalcheon, Senior Vice-President at BDO Debt Solutions told VICE Money.Mihalcheon points to cost of living and poor credit choices as reasons why students are still leaving school with massive amounts of debt. In her experience, students fall into the red early because of readily available credit with minimal requirements. Many don’t bother looking for solutions until too late. Tackling the problem earlier rather than later could save a lot of headaches.“Let’s plan how much student debt you are going to have. What kind of job do you actually have to have when you graduate to be able to pay this off?”A real and early education in financial planning and how to save would be a huge benefit to students. Alongside proper credit management Mihalcheon recommends everyone have an emergency fund, although she acknowledges that that’s indeed, rare.“I see the looks on people’s faces, and I can tell how many people have rainy day funds.”Government HelpThis time last year, students were just learning about the Ontario low income student grant. It was announced to great fanfare, that starting in 2017, Ontario students with families making under $50,000 a year would be eligible for free tuition.New Brunswick followed Ontario’s lead with a similar student grant plan that began in the fall of 2016. Both projects meant that Canadians who were originally unable to pursue post-secondary education because of its cost, now had the opportunity to do so.This was obviously a big deal for many considering the fact that average tuition fees have increased 30 per cent across Canada over the last decade.Now we’re not due for an update from Statistics Canada on student debt for the next little while, but it does feel like not much has changed since the millennium began. While lower-income students are certainly getting a hand, there are others who are losing out. Ontario is retiring its tuition and education tax credits to reshuffle into this low-income initiative.“We’ve seen some progressive measures from the provincial government with the inception of the Ontario student grants and targeted assistance for low income families, [but] there is still a lot to be done,” Canadian Federation of Students national chairperson Bilan Arte told VICE Money.The CFS has long understood the costs and challenges that today’s college and university students face across Canada. They see these grants as a stopgap solution before what they hope is a wider implementation of free post-secondary education.“When we look back a generation, young people — while graduating or just a few years out of graduation — were able to think about purchasing a home, starting a new business, making large purchases and investments like getting a new car,” said Arte.

According to the chart above, students in Atlantic Canada carry some of the greatest levels of debt as undergraduates. An undergraduate student’s debt load in Newfoundland and Labrador hasn’t changed much between 2000 and 2010, but still ends up being surprisingly high considering the province’s capped tuition costs. British Columbia has also seen a pretty wild increase since 2000 with $12,000 more in average debt load after a student has completed his or her undergraduate degree.It seems that, for the most part, Canadian students still need to either shell out big money or rely on government and private loans to finance their undergraduate degrees. In fact, students have been left with a collective debt of $28.3 billion according to a 2012 report from Statistics Canada. But what’s interesting is that provinces with the highest tuition fees don’t necessarily rack up the highest amount in student debt.When you look at the numbers, Ontario remains on top for average tuition costs (it cost $8114 on average in the 2016/2017 year) but remains in the middle of the pack when it comes to average student debt (roughly $27,000 according to 2010 Stats Can data).B.C. has a higher average debt to tuition ratio, meaning that for the amount they pay in tuition fees, their debt loads are pretty high.But the Atlantic provinces continue to stand out. In the 2016/2017 academic year, tuition fees for undergraduates in Nova Scotia was $7218 on average. The latest numbers (2010) on debt show us that they graduated with a debt load of almost $40,000. That number has surely increased in the last seven years, and is way above the overall cost of tuition.“It’s not the tuition fees, it’s the fact that you have to live somewhere for eight, to nine, to ten months of the year while you’ve got no money coming in,” Donna Mihalcheon, Senior Vice-President at BDO Debt Solutions told VICE Money.Mihalcheon points to cost of living and poor credit choices as reasons why students are still leaving school with massive amounts of debt. In her experience, students fall into the red early because of readily available credit with minimal requirements. Many don’t bother looking for solutions until too late. Tackling the problem earlier rather than later could save a lot of headaches.“Let’s plan how much student debt you are going to have. What kind of job do you actually have to have when you graduate to be able to pay this off?”A real and early education in financial planning and how to save would be a huge benefit to students. Alongside proper credit management Mihalcheon recommends everyone have an emergency fund, although she acknowledges that that’s indeed, rare.“I see the looks on people’s faces, and I can tell how many people have rainy day funds.”Government HelpThis time last year, students were just learning about the Ontario low income student grant. It was announced to great fanfare, that starting in 2017, Ontario students with families making under $50,000 a year would be eligible for free tuition.New Brunswick followed Ontario’s lead with a similar student grant plan that began in the fall of 2016. Both projects meant that Canadians who were originally unable to pursue post-secondary education because of its cost, now had the opportunity to do so.This was obviously a big deal for many considering the fact that average tuition fees have increased 30 per cent across Canada over the last decade.Now we’re not due for an update from Statistics Canada on student debt for the next little while, but it does feel like not much has changed since the millennium began. While lower-income students are certainly getting a hand, there are others who are losing out. Ontario is retiring its tuition and education tax credits to reshuffle into this low-income initiative.“We’ve seen some progressive measures from the provincial government with the inception of the Ontario student grants and targeted assistance for low income families, [but] there is still a lot to be done,” Canadian Federation of Students national chairperson Bilan Arte told VICE Money.The CFS has long understood the costs and challenges that today’s college and university students face across Canada. They see these grants as a stopgap solution before what they hope is a wider implementation of free post-secondary education.“When we look back a generation, young people — while graduating or just a few years out of graduation — were able to think about purchasing a home, starting a new business, making large purchases and investments like getting a new car,” said Arte.

Now, says Arte, most can’t think beyond their monthly student loan payments.

Advertisement

Advertisement

Now, says Arte, most can’t think beyond their monthly student loan payments.